Russia’s coronavirus recovery plan has no space for renewables

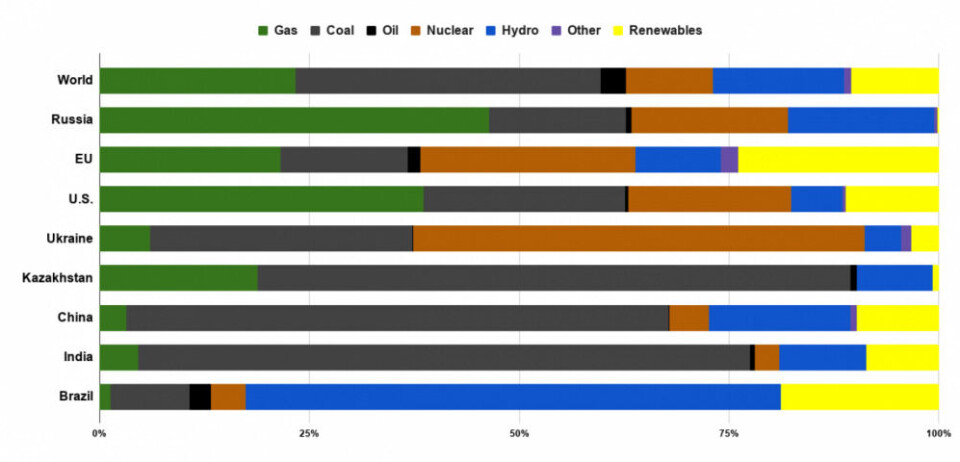

Just 0.16% of Russia’s electricity comes from renewable sources.

Text: Jake Cordell

“Medium-term plans for [renewables] capacity are at a very low level — even compared to our neighbors like Ukraine, Uzbekistan or Kazakhstan, without considering China or the U.S.,” Zhikharev added, pointing out that China commissions 100 times more capacity per year in new renewable energy projects than Russia.

The Kremlin’s latest energy strategy, in force from June and running until 2035, makes little mention of renewables or a transition to clean energy, said Maria Shagina, a researcher who focuses on Russia’s energy sector. It even pencils in higher investment in coal projects — seen by many as the dirtiest kind of fossil fuel. When Russia talks of energy diversification or an energy transition, it usually means balancing export markets for vital multi-billion dollar oil and gas exports, she added.

“The strategy is definitely one, if not two steps behind what’s happening. And the pandemic has compounded that and made it even worse,” Shagina said.

Completely unprepared

Russia is “completely unprepared,” for a world moving away from hydrocarbons and becoming more and more committed to tackling climate change, said Tatiana Mitrova, director of the Skolkovo Energy Center.

“The Russian government is… very sceptical concerning the anthropogenic nature of climate change,” she told The Moscow Times. This leads to a passive, box-ticking approach to green initiatives — such as Russia’s belated ratification of the Paris Climate Accords, when the Kremlin eventually signed up, but chose a baseline emissions level so high that it requires practically no effort to ensure compliance.

Mitrova is among those pushing the Russian government to incentivize renewables and make the economy more green.

“We should use this period when the state will be launching stimulus packages to push economic growth, to use at least some part of it for green technologies.”

But a detailed package of green proposals put to the Russian government over the last few months wasn’t met with enthusiasm. Analysts say the state’s capacity for supporting the energy industry is dominated by big ticket or geopolitical projects like the OPEC+ agreement, tax breaks for Arctic oil or LNG projects and flagship pipelines like Nord Stream 2 to Europe and the Power of Siberia to China.

This article first appeared in The Moscow Times and is republished in a sharing partnership with the Barents Observer.